Cass County Marks Major Milestone with Successful Distress Warrant Project

09/17/2024

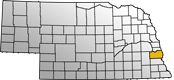

This year marks a significant milestone for Cass County, as all back personal property and improvement on lease land (IOLL's) taxes were successfully collected or submitted to be cleared by a lawful exception and on time-an unprecedented achievement for Cass County in modern times. Improved collaboration, enhanced training, and a steadfast commitment to excellence within the Cass County Sheriff's Office were pivotal in the success of the project. Historically, the Court Services Division team operated as an extension of the Cass County Sheriff's Office Corrections Division, comprising certified deputies with the same certification and full arrest powers of deputies assigned to the Road Patrol Division.

Sheriff Robert Sorenson of Cass County recognized that while the Court Services team had significant training and talent, it was underutilized in certain areas. There was a lack of internal and external recognition, understanding, and cohesion among team members. Historical documents within the office referred to the division by various names, such as "Court Services," "Transport," and "Court Security." Following initial structural changes implemented by Sheriff Sorenson, including adopting a unified division name, the team flourished. Their daily responsibilities include providing courtroom security, transporting inmates, and safeguarding the courthouse and annex buildings. Additionally, they have expanded their roles to enhance oversight and proactively monitor registered sex offenders for compliance, and they have taken on new responsibilities such as conducting background checks for non-certified staff, aiding in the execution of civil process papers, and handling distress warrants-a legal tool used by county treasurers to recover unpaid personal property taxes.

When someone fails to pay their taxes on time, the county treasurer sends them a tax statement detailing the amount owed, including any outstanding taxes from previous years. If taxes on personal property, mobile homes, or similar items remain unpaid by October 1st, the treasurer notifies the taxpayer, granting them 20 days to settle the debt. Should payment still not be made, a distress warrant is issued, empowering the county sheriff and deputies to collect the delinquent taxes and, if necessary, seize the taxpayer's personal property to satisfy the debt. The sheriff is responsible for conducting thorough investigations and exhausting all lawful efforts to recover distress warrant taxes. A common example of a lawful exception is a mobile home that no longer exists at the property. If property is seized, it is sold, and any surplus funds are returned to the owner. Annually, the sheriff must report to the Treasurer's Office and the county board on both collected and uncollected taxes, ensuring all efforts are fully documented. Partial payments can be accepted as part of a larger payment plan. If a taxpayer relocates, the distress warrant is transferred to the sheriff in their new county of residence. This process ensures that taxes are ultimately collected, even if initially unpaid. The county treasurer can accept the sheriff's distress warrant report as early as July 1st, with a final submission deadline of August 1st. Cindy Fenton, the Cass County Treasurer, and her staff do an exceptional job for Cass County. She plays a crucial role in this process, and her dedicated service throughout this project was especially helpful to its success.

The court services team approached the distress warrant project with humility and professionalism, benefiting everyone involved. Some distress warrants had remained uncollected or unresolved for over 15 years, presenting significant challenges for the team. Recent recognition among Nebraska sheriffs of deficiencies in civil process and distress warrant training underscored broader issues. Outdated laws and inadequate formal training likely contributed to past challenges with distress warrants in Cass County, echoing concerns across the state.

Sheriff Sorenson identified a need for his office to better understand and evaluate the distress warrant process. Collaborating with the Buffalo County Sheriff's Office, led by Sheriff Neil Miller, Sheriff Sorenson and his staff developed a plan. A select group of Cass County personnel traveled to Kearney, NE, for specialized one-on-one training with Buffalo County Sgt. Ted Huber, an experienced expert who has developed standards, guidelines, and best practices for civil process and distress warrants and was excited to share it with Cass County.

Upon returning, the court services team promptly took the lead in communicating and collaborating within their team as well as other Cass County offices, including the treasurer's, assessor's, and county attorney's offices. This collective effort propelled the distress warrant project forward, yielding unprecedented results that were previously difficult to imagine.

Improved communication within the court services team and with the treasurer's office has developed into a more efficient and transparent approach, helping citizens understand their outstanding tax obligations clearly and leading to unprecedented results. This collaboration also ensured that the sheriff's office and treasurer's office could assist each other in verifying and guaranteeing the accuracy of tax collections. Furthermore, enhanced communication with the assessor's office enabled deputies to clarify citizen assumptions about property valuations, particularly regarding older outstanding back taxes, and to rectify innocent errors in assessed values.

Recently, Sheriff Sorenson met with the team to discuss their efforts. Leading the five-person Court Services Division team, Sgt. Amber Gray spearheaded the distress warrant project. Sgt. Gray and her team reflected on the challenges and successes of managing distress warrants with empathy for taxpayers while maintaining accountability to those who promptly pay taxes, thus ensuring county funds are collected to help support quality services. The team recognizes ongoing opportunities to improve communication and collaboration across Cass County offices, ultimately benefiting the community. Sheriff Sorenson expressed deep gratitude for the team's dedication, highlighting them as a prime example of exceeding expectations through effective teamwork both within and beyond the sheriff's office.

During this year's distress warrant project, the Court Services team successfully collected $55,356.02 in back taxes and interest, marking a significant achievement for Cass County. Of the 162 distress warrants processed, 85% of the owed taxes were recovered, with the remaining 15% cleared due to lawful exceptions. Notably, all collections were made without the need to seize personal property, highlighting the team's meticulous approach and collaborative spirit across county offices. The early completion of the project in June allowed extra time to fine-tune the processes and reporting to the treasurer's office. The early submission of the report also offered additional opportunities for the treasurer's office to finalize their tax documentation and processes.

This unprecedented success not only enhances the county's financial resources but also underscores the importance of collaborative efforts in serving the community. The achievement of collecting $55,328.20 in back taxes and interest, despite initial challenges, reflects the dedication and professionalism of Cass County's Court Services team. A summary report of the distress warrant project was presented in cooperation with the county treasurer's office the Cass County Commissioners during there recent September 10, 2024, meeting.

This unprecedented success not only enhances the county's financial resources but also underscores the importance of collaborative efforts in serving the community. The achievement of collecting $55,328.20 in back taxes and interest, despite initial challenges, reflects the dedication and professionalism of Cass County's Court Services team. A summary report of the distress warrant project was presented in cooperation with the county treasurer's office to the Cass County Commissioners during the recent board meeting on September 10, 2024.

The success of the Cass County Sheriff's Office in handling distress warrants marks a transformative moment for the county, ensuring fair tax collection while boosting funding for essential services. This groundbreaking achievement sets a new benchmark for county operations, showcasing the incredible power of teamwork and dedication to community service. Sheriff Sorenson is championing this approach across his office, fostering a spirit of excellence and collaboration. With ongoing enhancements in training, equipment, salaries, and benefits, the Sheriff's Office is poised to develop, retain, and attract top-tier talent, creating a culture of unparalleled commitment and success. The future of Cass County looks brighter than ever, with a unified team ready to take on new challenges and deliver exceptional results.